Dubai, U.A.E- Dubai Aerospace Enterprise (DAE) Ltd (“DAE”) today reported its financial results for the six months ended June 30, 2024. The consolidated financial statements can be found here.

Selected Financial Highlights:

| Six months ended | ||

| US$ millions | Jun 30, 2024 | Jun 30, 2023 |

| Total Revenue | 679.2 | 670.1 |

| Profit before Tax | 154.3 | 150.4 |

| Operating Cash Flow | 612.4 | 643.4 |

| Pre-Tax Profit Margin | 22.7% | 22.4% |

| Pre-Tax Return on Equity | 11.0% | 10.3% |

| As at | ||

| US$ millions | Jun 30, 2024 | Dec 31, 2023 |

| Total Assets | 12,855.5 | 12,262.5 |

| Net Loans and Borrowings | 8,328.4 | 7,592.1 |

| Available Liquidity | 4,922.9 | 4,062.2 |

| Net-Debt-to-Equity | 2.58x | 2.53x |

| Unsecured Debt Percentage | 77.6% | 73.3% |

| Liquidity Coverage Ratio | 241% | 290% |

Selected Business and Operating Highlights:

- Unsecured credit ratings upgraded to Baa2 by Moody’s and to BBB by Fitch Ratings

- Number of aircraft acquired: 10 (owned: 4; managed: 6)

- Number of aircraft sold: 11 (owned: 10; managed: 1)

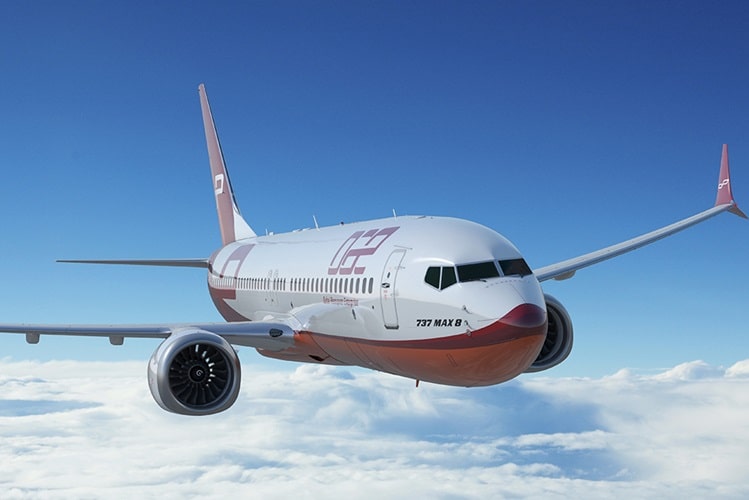

- 737 MAX Order book placement: 2024: 100%; 2025: 100%

- Lease agreements, extensions, and amendments signed: 77 (owned: 61; managed: 16)

- Owned portfolio contracted: 3%

- Number of man hours booked (DAE Engineering): ~807,000

- Number of checks performed (DAE Engineering): 162

Commenting on the results, Firoz Tarapore, Chief Executive Officer of DAE, stated, “The continued strength of demand for both leased aircraft and airframe maintenance can be seen in both the growth of our top line revenue and profitability, and in improvements to our margins and returns. We continue to demonstrate exemplary financial prudence, including our rock-solid commitments to capital adequacy and our exceptional liquidity of US$4.9 billion, which contributed to recent upgrades to our long-term credit ratings from both Moody’s Investors Service and Fitch Ratings.

The trading market remains a robust channel for buying and selling aircraft. We are actively evaluating acquisitions and divestments of aircraft portfolios. We expect the second half of 2024 to be an active period.

Our order book positions are placed until the second quarter of 2026, although continued delivery uncertainty from Boeing is delaying near-term deliveries.

In July, DAE announced that it has recommenced its bond repurchase program, and is now providing indicative bids directly through Bloomberg across its bond maturity ladder. As of June 30, 2024, DAE had available authorization to repurchase up to US$274 million of outstanding bonds.

DAE Engineering is continuing to see exceptional revenue and profitability growth. For the first half of 2024, revenue increased by 33% to US$92 million, and profitability increased by 103% to USU$20.5 million. Deployment of additional hangar capacity is progressing at pace at our facility in Amman, Jordan, and our aim is to have an additional five hangar lines in operation prior to year-end 2024.”

Webcast and Conference Call

In connection with the announcement of DAE’s results for the six months ended June 30, 2024, management will host a conference call on Wednesday, July 31, 2024 at 09:00 EDT / 14:00 BST / 17:00 GST / 21:00 SGT.

The call can be accessed live by clicking here from your laptop, tablet, or mobile device, or by dialing one of the global dial-in numbers and quoting ‘Dubai Aerospace Enterprise’ when prompted.

Full details of the call can also be accessed live via the link on DAE’s website:

www.dubaiaerospace.com/investors.

Forward Looking Statements

Certain information contained in this Press Release may constitute “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “could”, “continue”, “expect”, “anticipate”, “predict”, “project”, “plan”, “estimate”, “budget”, “assume”, “potential”, “future”, “intend” or “believe” or the negatives thereof or other comparable terminology. These statements reflect DAE’s current expectations and assumptions and involve known and unknown risks regarding future events, results or outcomes and are not guarantees of future results or financial condition. Actual results, performance, achievements, or conditions may differ materially from those in the forward‐looking statements and assumptions as a result of a number of factors, many of which are beyond DAE’s control.

Non-IFRS Financial Information

This Press Release may include certain non-IFRS financial information, such as Adjusted EBITDA, not prepared in accordance with IFRS. Because of the limitations of Adjusted EBITDA, it should not be considered as a substitute for financial information prepared or determined in accordance with IFRS, as applicable. Where applicable, DAE compensates for these limitations by relying primarily on its IFRS results and using Adjusted EBITDA only for supplemental purposes.