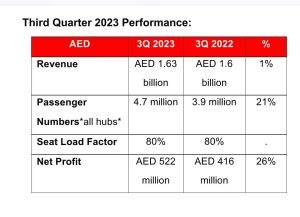

• Third quarter 2023 net profit increases 26% reaching AED 522 million; and 21% increase in number of passengers carried.

• The financial and operational results are an all-time record high for the carrier.

Sharjah, UAE;-: Air Arabia (PJSC), the Middle East & North Africa’s first and largest low-cost carrier operator, today announced a record financial and operational results for the third quarter and first nine months ending September 30, 2023.

Air Arabia reported an all-time record AED 1.32 billion net profit the first nine months ending September 30, 2023, an increase of 53 per cent compared to the same period last year, while revenue for the first nine months increased by 16 per cent reaching an impressive AED 4.45 billion.

Sheikh Abdullah Bin Mohamed Al Thani, Chairman of Air Arabia, said: “Air Arabia maintained its robust growth in the first nine months of this year by expanding operations across its seven operational hubs and introducing new routes to enhance the carrier’s global network. The increase in capacity during this period was complemented by an impressive surge in passenger numbers, reaching a total of 12.4 million, and marking a remarkable 36 per cent increase compared to the first nine months of last year. Air Arabia remains unwavering in its commitment to diversify and expand its business, while simultaneously investing in innovative products that aim to enhance every aspect of our customers’ journey.”

Air Arabia also reported record profitability of AED 522 million for the third quarter ending September 30, 2023; an increase of 26 per cent compared to the same period last year, while revenue for the third quarter 2023 reached an impressive AED 1.63 billion.

Al Thani continued: “Air Arabia’s record performance in the third quarter of this year was driven by robust passenger demand and effective cost control measures implemented by the management team. The remarkable performance is a testament to Air Arabia’s operational and commercial strategy, demonstrating the company’s steadfast commitment to consistently providing genuine value to its customers.”

Nine Months 2023 Highlights:

Fleet

• Two leased Airbus A320 aircraft were added during the third quarter bringing the total fleet to 72 leased and owned Airbus A320 and A321.

• Four short-term leased Airbus A320 aircraft were added to Morrocco hub during the third quarter to support summer season operations.

Network

• Air Arabia added a total of 17 new routes to its global network in the first nine months 2023 bringing the total network size to 206 routes from seven operating hubs.

• The capacity available across all hubs increased by 33 per cent during the first nine months 2023 compared to the same period last year.

Digital Transformation

• Full implementation of an Enterprise Resource Planning (ERP) to drive automation and efficiency.

• Rollout of Electronic Tech Logbook and upgrade of Electronic Flight Bag equipment to achieve a paperless and efficient process across operations.

Liquidity

• AED 4.9 billion in cash and cash equivalent.

Recognition

• Air Arabia was awarded “Low-Cost Airline of the year” and ranked the highest operating margin in the world by Airline Weekly as well as first on the Airfinance journal top 100 airlines worldwide for four consecutive years.

• Fly Jinnah tops Pakistan Civil Aviation ranking for outstanding punctuality and regularity.

• Fly Arna successfully obtains IOSA certificate.

Social Responsibility

• A new medical clinic was established in Tajikistan in the first nine months 2023, joining the 15 schools and clinics that Air Arabia’s corporate social responsibility programme “Charity Cloud’ currently runs across 12 countries.

Outlook

Al Thani concluded: “The demand for our value-driven product continues to be solid and we remain cautiously optimistic as we continue to navigate the ever-changing landscape of the current geopolitical and macroeconomic environment. Equally, we remain focused on innovation, efficiency, and cost control across the breadth of our operations. While challenges persist in the near term, we have full confidence in the business model that we operate, our ability to continue driving growth, and our product offering that continuously delivers optimum value to our customer.”